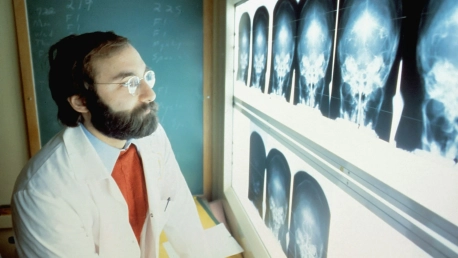

The Union Budget of 2024-25 has introduced significant changes to the healthcare sector in India, particularly focusing on the revision of duties on X-ray devices. This policy shift aims to stimulate local manufacturing and reduce dependency on imported components, creating a ripple effect anticipated to benefit various facets of the industry, from manufacturing to patient care. The revision of the Basic Customs Duty (BCD) on X-ray tubes and flat panel detectors is seen as a crucial step in the government’s broader initiative to promote indigenous production capabilities, aligning with the “Make in India” agenda. By reducing the costs associated with importing these essential components, the government aims to provide a level playing field for domestic manufacturers. This policy adjustment has been warmly welcomed by healthcare experts, who foresee transformative impacts on the quality, accessibility, and cost of healthcare services across the country.

Encouraging Domestic Manufacturing

The revised Basic Customs Duty on X-ray tubes and flat panel detectors is designed to invigorate local manufacturing, allowing Indian companies to compete more effectively against international players. By reducing import costs, domestic manufacturers are incentivized to invest in the production of high-quality diagnostic equipment, thus fostering innovation within the sector. This shift towards local production is expected to enhance the overall quality and reliability of diagnostic tools available in the market. Manufacturers may channel the savings from reduced import duties into research and development, leading to the creation of cutting-edge technologies that meet international standards.Healthcare experts have expressed optimism about this move, predicting significant growth in the medical device industry. With lower production costs, manufacturers will be able to offer competitively priced products, which could open up new opportunities for exports. This development is also likely to bolster India’s position in the global healthcare market, making it a hub for high-quality, cost-effective medical devices. The anticipated influx of investment in local manufacturing is expected to create a more robust and dynamic medical technology ecosystem, capable of addressing both domestic and international needs.

Impact on Healthcare Costs

One of the most profound impacts of the revised customs duty is expected to be on the overall cost of healthcare in India. Lowering the expenses associated with procuring X-ray machines can enable healthcare providers to offer more affordable services. This reduction in operational costs is particularly vital for diagnostic imaging, a crucial component in the diagnosis and treatment of various medical conditions, including cancer. The benefits of this cost reduction are expected to be far-reaching, especially for lower-income groups who may have found high-quality diagnostic imaging services prohibitively expensive.A significant decrease in the cost of diagnostic services can make crucial healthcare services more accessible to a broader population. Reduced operational costs for healthcare providers can also lead to a decrease in the fees charged for diagnostic services, making them more affordable. Moreover, the cost savings from lower import duties can be redirected to other critical areas within healthcare facilities, such as upgrading existing equipment, expanding services, or hiring specialized personnel. This holistic improvement can contribute to a more efficient and effective healthcare system overall, providing patients with better care and outcomes.

Improving Healthcare Accessibility

The revision of duties on X-ray devices addresses the longstanding challenge of accessibility to advanced diagnostic tools, particularly in rural and remote areas. Increased domestic production is expected to create a more reliable and accessible supply chain, ensuring that smaller healthcare centers across the country can access the latest diagnostic equipment. This shift is anticipated to bridge the gap between urban and rural healthcare, enhancing diagnostic accuracy and treatment outcomes in less developed regions. By extending the reach of advanced medical technologies, the policy supports the government’s goal of achieving equitable healthcare access for all citizens.The availability of advanced diagnostic tools in rural areas can lead to more timely and accurate diagnoses, ultimately improving patient outcomes. Enhanced access to diagnostic imaging can be particularly beneficial in detecting and monitoring conditions such as cancer, where early diagnosis can significantly affect treatment success rates. Moreover, the policy is expected to facilitate the establishment of more comprehensive healthcare services in underserved areas, contributing to the overall improvement of healthcare infrastructure in the country.

Economic Ramifications

The economic implications of the revised customs duty extend well beyond the healthcare sector. Encouraging domestic manufacturing is anticipated to stimulate local economies by creating job opportunities and driving investments in infrastructure and technology. The development of a robust manufacturing ecosystem for medical devices can attract both national and international investments, further bolstering the industry. As companies expand their operations and production capabilities, ancillary industries that supply raw materials and components will also experience growth, leading to a more integrated and dynamic economic landscape.In addition to domestic benefits, the increased export potential of Indian-manufactured X-ray devices can make a substantial contribution to the country’s overall trade balance. By establishing itself as a global supplier of high-quality diagnostic equipment, India can strengthen its economic position and drive revenue growth in the healthcare technology sector. This growth in exports is expected to generate additional economic benefits, such as increased foreign exchange earnings and a stronger presence in the international market for medical devices.

Challenges and Considerations

Despite the largely positive outlook, the implementation of the revised customs duty on X-ray devices does present some challenges and considerations. Manufacturers will need to navigate a transition period as they adapt to new production processes, which may initially present hurdles. Ensuring consistent quality and meeting regulatory standards will be critical for gaining and maintaining market acceptance, both domestically and internationally. This focus on quality assurance will be essential for the success and sustainability of the policy.Additionally, the policy’s current focus on X-ray devices leaves other medical technologies unaffected, suggesting the need for a more comprehensive strategy to address various segments of the medical equipment industry. Achieving broader self-reliance in the healthcare sector may require similar revisions in duties for other critical medical devices and technologies. Ongoing support from the government in the form of subsidies, tax breaks, and funding for research and development will be crucial to ensure that the initial gains from the revised customs duty are sustained and built upon for long-term success.

Future Outlook

The revised customs duty is set to significantly impact the overall cost of healthcare in India. By lowering expenses for procuring X-ray machines, healthcare providers can offer more affordable services. This reduction in operational costs is crucial for diagnostic imaging, essential in diagnosing and treating medical conditions like cancer. The cost savings are expected to benefit lower-income groups the most, for whom high-quality diagnostic imaging services have been prohibitively expensive.Making diagnostic services more affordable can broaden access to critical healthcare services. Reduced operational costs for healthcare providers can translate into lower fees for diagnostic services, enhancing affordability. Additionally, savings from reduced import duties can be reinvested in other key areas within healthcare facilities, such as upgrading existing equipment, expanding service offerings, or hiring specialized personnel. This comprehensive improvement can lead to a more efficient and effective healthcare system, ultimately providing better care and outcomes for patients.