The steadily increasing costs of health benefits in the United States present a serious challenge for employers. With health benefit expenses outpacing general inflation, organizations are seeking innovative strategies to cope. This article delves into the primary factors contributing to these rising costs, the projected trends leading up to 2025, and the methods employers are using to manage their expenses effectively.

Key Factors Driving Health Benefit Cost Increases

Utilization and Service Demands

In recent years, there has been a noticeable rise in the utilization of specific health services, particularly in behavioral healthcare and various medications. Employers have observed a moderate impact on overall costs from these trends, but the underlying demand places upward pressure on prices. As the population ages and the prevalence of chronic conditions increases, more Americans are seeking and requiring medical services. This sustained demand for healthcare often outstrips the available supply of healthcare providers, intensifying overall costs and stretching the healthcare system thin.

Chronic conditions such as diabetes, hypertension, and mental health issues require continuous and comprehensive care, further driving up costs. An aging population, particularly the baby boomer generation, is particularly impactful as they typically need more frequent and intensive medical attention. Moreover, the increased demand for specialized treatments and advanced medications like GLP-1 for diabetes management and newer mental health medications further exacerbates the cost issue. This high demand, coupled with a limited supply, results in greater competition for medical resources, which drives up costs for both employers and employees.

Healthcare Worker Shortages and System Inefficiencies

The gap between the demand for healthcare services and the supply of healthcare workers is widening. As the baby boomer generation ages, healthcare needs are becoming more acute. Simultaneously, the healthcare workforce is struggling to keep pace, creating a deficit that drives up costs through increased wages and reliance on overtime. Moreover, inefficiencies within the healthcare system, exacerbated by technological and administrative burdens, add to the operational costs that get passed along to consumers and employers. Large healthcare systems consolidating power often result in price hikes, as these entities capitalize on their dominant market positions. This consolidation can lead to reduced competition, enabling larger systems to set higher prices for services.

Healthcare labor shortages also contribute to this dynamic, as hospitals and clinics offer higher wages to attract and retain staff, costs that ultimately find their way into higher health benefit expenses for employers. Furthermore, administrative challenges such as complex billing systems, regulatory compliance, and electronic health record maintenance add another layer of cost. These inefficiencies can lead to wastage and increased operational expenses, which are then passed on to consumers in the form of higher prices for services and treatments. Consequently, the combined effect of healthcare worker shortages and systemic inefficiencies creates a challenging environment for controlling health benefit costs.

Price Dynamics and Consolidation in Health Systems

Consolidation’s Impact on Costs

Healthcare system consolidation has become a double-edged sword. While it may lead to operational efficiencies and improved patient care coordination in the long run, in the short term, it strengthens the bargaining power of large health systems. These entities can negotiate higher prices for services, pushing costs up for employers and, by extension, employees. The ability of large healthcare systems to command higher prices due to their scale and market dominance means that smaller providers struggle to compete, leading to less competitive pricing and higher costs overall. Employers are often caught in this trap, as they lack the negotiating power to counter these large healthcare entities’ demands.

Additionally, while consolidation might bring about some long-term operational efficiencies, the immediate effect is often a reduction in competition that could help keep prices in check. As large systems absorb smaller providers, the market becomes less diverse, giving consolidated entities more control over pricing. This dynamic can lead to increased costs for employer-sponsored health plans as the negotiating power shifts away from employers. Furthermore, consolidated healthcare systems might also result in less personalized care and decreased innovation, as smaller, more nimble providers exit the market. Overall, the consolidation of healthcare systems poses significant challenges for cost containment efforts.

Macro-Economic Influences

Broader economic factors also influence healthcare costs. While general inflation rates may cool, the structural issues within the healthcare sector, such as labor shortages and system inefficiencies, keep healthcare costs rising. Employers thus face external economic conditions that compound the difficulty of managing health benefit expenses. For instance, macroeconomic trends like wage inflation in the healthcare sector contribute to rising operational costs. Healthcare providers, facing higher wages for their staff, pass these costs on to consumers and employers in the form of increased service charges.

In addition, global economic conditions, such as supply chain disruptions and increasing costs for medical supplies and equipment, further push up prices. Technological advancements, while beneficial for improving healthcare outcomes, often come with high costs that are incorporated into healthcare service pricing. These macroeconomic factors create a challenging landscape for employers who are trying to manage their health benefit expenses amidst an environment of unwavering cost increases. Employers are thereby compelled to adopt more sophisticated and proactive cost-management strategies to mitigate the impact of these economic influences on their health benefit budgets.

Rising Prescription Drug Costs

Accelerating Prescription Drug Expenses

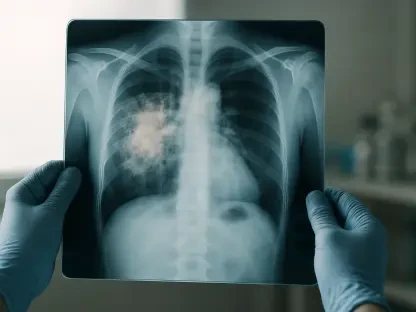

A significant contributor to rising health benefit costs is the rapid escalation in prescription drug prices. Employers report substantial increases in drug benefit costs, with a 7.2% rise noted per employee for 2024. This sharp increase is fueled by the introduction of high-cost medications, including innovative gene and cellular therapies that promise groundbreaking treatments but come at exorbitant prices. As pharmaceutical companies continue to develop and market these advanced therapies, the financial impact on employer-sponsored health plans becomes increasingly significant. The high costs of these medications are often due to the intensive research and development, regulatory approval, and manufacturing processes involved in bringing these products to market.

Additionally, the pricing strategies employed by pharmaceutical companies, such as maintaining exclusivity and patent protections, contribute to sustained high prices. Employers are therefore finding it increasingly challenging to provide comprehensive drug benefits without incurring substantial costs. The lack of generic alternatives for many of these advanced therapies also limits employers’ options for managing expenses. Consequently, the escalating costs of prescription drugs remain a pressing concern for employers as they strive to balance the need for access to cutting-edge treatments with the imperative to control overall health benefit costs.

The Role of High-Cost Therapies

The advent of high-cost therapies like gene and cellular treatments imposes additional financial burdens on employers. These therapies, while potentially life-saving and revolutionary, dramatically hike up the overall costs of providing health benefits. Employers are, therefore, compelled to explore alternative ways to manage these expenses without compromising the quality of care. For example, some employers are looking into value-based payment models where the cost of a treatment is tied to its effectiveness and the health outcomes achieved. This approach aims to ensure that the high costs of advanced therapies are justified by tangible benefits to patients’ health.

Employers are also investing in disease management programs to help employees manage chronic conditions more effectively, thereby reducing the need for costly interventions. Furthermore, specialty pharmacy management programs are being implemented to optimize the use of high-cost medications and ensure that employees receive the necessary support and education to adhere to their treatment regimens. These strategies represent a multifaceted approach to controlling the impact of high-cost therapies on health benefit expenses, highlighting the complexity of managing prescription drug costs within employer-sponsored health plans.

Employer Strategies to Manage Rising Costs

Adopting Cost-Reduction Measures

In response to rising health benefit costs, many employers are taking preemptive steps to mitigate the impact. Mercer’s 2024 National Survey of Employer-Sponsored Health Plans indicates that without intervention, health benefit costs could increase by as much as 7%. However, with strategic cost-reduction measures, this figure can be lowered to 5.8%. These measures include various initiatives such as wellness programs aimed at improving employee health and reducing the incidence of chronic conditions. By encouraging healthier lifestyles, employers hope to curb healthcare utilization and, in turn, control costs.

Another approach employers are adopting is the use of narrow or high-performance networks that contract with selected providers who deliver high-quality care at lower costs. Employers are also leveraging telemedicine and virtual care services more extensively, offering employees convenient and cost-effective options for accessing medical care. Providing education and tools to help employees make informed healthcare decisions is another critical aspect of cost management strategies. By empowering employees to seek the most appropriate and cost-effective care options, employers can further control the rising expenses associated with health benefits.

Raising Deductibles and Out-of-Pocket Expenses

One of the common strategies involves increasing deductibles and other cost-sharing components. By shifting a greater portion of healthcare costs to employees, employers manage to keep their overall expenses in check. This approach, though effective from a cost-containment perspective, often results in higher out-of-pocket costs for employees, impacting their financial health. While this strategy helps employers manage their budgets, it can lead to increased financial strain on employees, who may face higher medical bills and greater uncertainty about their healthcare expenses.

Employers are also considering alternative cost-sharing arrangements such as health savings accounts (HSAs) and high-deductible health plans (HDHPs). These options provide employees with more control over their healthcare spending while offering tax advantages. Additionally, some employers are exploring the use of reference-based pricing models where they set a maximum contribution for specific services and employees pay the difference if they choose a provider who charges more. These strategies reflect the need to balance cost control with the potential financial impact on employees, underscoring the complex trade-offs involved in managing rising health benefit costs.

Future Outlook and Projections

Projected Trends for 2025

Looking ahead to 2025, the trend of rising health benefit costs is expected to persist. Employers, particularly smaller businesses with fully insured plans, anticipate significant increases unless cost-management actions are implemented. On average, these businesses project a 9% rise in health benefit costs without intervention. Small and medium-sized enterprises (SMEs) often face greater challenges in negotiating favorable terms with healthcare providers and insurers compared to larger organizations with more substantial bargaining power.

To counteract these projected increases, SMEs are exploring a variety of innovative cost-management strategies. These include joining purchasing coalitions to leverage collective bargaining power, adopting alternative funding arrangements like level-funded plans, and partnering with third-party administrators to manage claims more efficiently. Additionally, SMEs are increasingly turning to data analytics to identify cost drivers and implement targeted interventions to mitigate rising expenses. These strategies highlight the proactive steps that smaller employers are taking to manage the financial pressures associated with escalating health benefit costs.

Employee Premium Contributions

Employers in the United States are grappling with the escalating costs of health benefits, which represent a growing challenge. The expenses for health benefits are increasing much faster than general inflation, pushing organizations to seek inventive ways to manage these rising costs. This article explores the main factors driving these costs upward, including aging populations, increased utilization of medical services, and the high prices associated with new technologies and prescription drugs. Furthermore, the article examines the projected trends in healthcare costs through 2025, noting that costs are expected to continue their upward trajectory. Employers are adopting different strategies to handle these expenses effectively, such as shifting more costs to employees, investing in wellness programs designed to reduce overall healthcare utilization, and adopting value-based care models. By implementing these approaches, employers aim to mitigate the financial burden of health benefits, ensuring both sustainability for their organizations and affordability for their employees.