In recent years, the pharmaceutical industry has witnessed a significant shift towards direct-to-consumer (DTC) sales and services. Pharmaceutical companies are increasingly moving to sell their products directly to consumers, bypassing traditional intermediaries like wholesalers, distributors, and pharmacies. This change is driven by several potential advantages, including cost savings, improved consumer data collection, and the ability to circumvent insurance limitations. This shift promises to enhance access to essential medications while potentially reshaping the overall healthcare landscape.

The Emergence of Direct-to-Consumer Models

Pfizer’s Initiatives: PfizerForAll

Pfizer has been at the forefront of the DTC movement, launching a new website called PfizerForAll in August 2024. This platform offers information on common health issues such as migraines and the flu and connects patients to telehealth services and prescription delivery options. Through PfizerForAll, patients can receive diagnostic tests and treatments, including Pfizer’s own medications like Paxlovid for COVID-19 and Nurtec for migraines, delivered straight to their homes. The initiative represents a significant step towards making healthcare more accessible and convenient for consumers, leveraging technology to streamline the process.

In addition to providing direct access to medications, PfizerForAll aims to empower patients by offering comprehensive health information and resources. The platform’s telehealth services enable patients to consult with healthcare providers from the comfort of their homes, minimizing the need for in-person visits. This approach not only enhances convenience but also reduces the burden on traditional healthcare facilities. By integrating telehealth with prescription delivery, Pfizer is pioneering a holistic approach to patient care that could serve as a model for other pharmaceutical companies looking to enter the DTC market.

Eli Lilly’s Approach: LillyDirect

Eli Lilly, another major pharmaceutical player, introduced LillyDirect in January 2024. This service provides direct delivery of prescriptions to patients’ doors. Furthermore, Eli Lilly partnered with Amazon Pharmacy to expand its reach, offering medications like Zepbound, a GLP-1 weight loss drug that competes with Ozempic. These innovative initiatives highlight how pharmaceutical companies are leveraging DTC models to enhance accessibility and convenience for patients. LillyDirect aims to simplify the medication purchase process for consumers, reducing the friction often associated with obtaining prescriptions through traditional channels.

The partnership with Amazon Pharmacy marks a strategic move for Eli Lilly, enabling the company to tap into Amazon’s vast distribution network and customer base. This collaboration ensures that medications are delivered efficiently and promptly, further enhancing the customer experience. By joining forces with one of the world’s leading e-commerce platforms, Eli Lilly is positioned to reach a broader audience and provide high-quality healthcare solutions directly to consumers’ doorsteps. This move underscores the growing trend of pharmaceutical companies seeking innovative ways to connect with patients and meet their healthcare needs more directly.

Motivations Behind the DTC Push

Insurance Challenges and Direct Access

Many employer insurance plans have been reluctant to cover high-cost medications like GLP-1 drugs. By selling directly to consumers, pharmaceutical companies can bypass these insurance denials, making their products more accessible to patients who need them. Robin Glass, president of the virtual care company Included Health, notes that employers, significant purchasers of healthcare, particularly worry about the costs of these expensive medications. As a result, the DTC model offers a viable solution for patients struggling to obtain necessary treatments through traditional insurance channels.

The ability to bypass insurance restrictions not only benefits patients by providing easier access to medications but also aligns with pharmaceutical companies’ financial interests. By selling directly to consumers, these companies can maintain control over pricing and avoid the complexities associated with insurance reimbursements. This approach can lead to a more transparent pricing structure, allowing patients to better understand the costs of their medications. Ultimately, DTC sales can help bridge the gap between patients and the treatments they need, fostering a more efficient and patient-centric healthcare system.

Gaining Consumer Insights

The traditional pharmaceutical supply chain, involving multiple checkpoints, has limited pharmaceutical companies’ ability to gather valuable data on consumer experiences with their products. DTC sales allow companies to collect “last-mile data,” as emphasized by Ron Gutman, co-founder and co-CEO of digital health company Intrivo. This data enables pharmaceutical companies to continuously refine and enhance their products based on firsthand consumer feedback. Understanding how patients use and respond to medications is crucial for improving product efficacy and ensuring patient satisfaction.

By directly interacting with consumers, pharmaceutical companies can gain deeper insights into patient preferences, behaviors, and outcomes. This information can inform future product development, marketing strategies, and patient support programs. Additionally, having access to real-time data allows companies to swiftly address any issues that arise, ensuring that patients receive the best possible care. The ability to gather and analyze consumer data represents a significant advantage of the DTC model, contributing to the overall advancement of healthcare solutions.

Technological and Financial Benefits

Cost Savings and Revenue Retention

Eliminating intermediaries, such as pharmacies, presents a significant cost-saving opportunity for pharmaceutical companies. When medications are sold through pharmacies, a portion of the profit goes to the pharmacies. However, selling directly to consumers allows pharmaceutical companies to retain a larger share of the revenue, potentially lowering overall costs for patients. This financial incentive is a driving factor behind the growing interest in DTC models, as companies seek to optimize their profit margins while offering competitive pricing to consumers.

The reduction in costs associated with intermediaries also translates to more predictable pricing for consumers. With direct sales, pharmaceutical companies can set prices based on production and distribution expenses, without the added markup from third-party sellers. This approach can lead to more affordable medications, making essential treatments accessible to a wider population. By streamlining the supply chain, pharmaceutical companies can pass on the savings to consumers, potentially improving medication adherence and health outcomes.

Leveraging Telehealth Advances

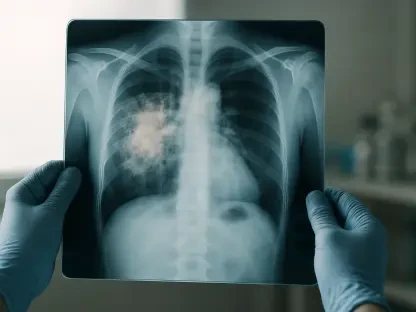

Advancements in telehealth have made it easier for pharmaceutical companies to pursue DTC services. Telehealth platforms streamline communication between patients and healthcare providers, facilitating the delivery of prescription medications directly to patients’ homes. Furthermore, advances in drug development, such as oral versions of popular GLP-1 drugs being tested by Pfizer and Eli Lilly, create new opportunities to capitalize on the DTC trend. Telehealth not only enhances convenience but also supports the broader goal of integrating technology into healthcare delivery.

The integration of telehealth services with DTC models offers a seamless experience for patients, from diagnosis to treatment. Patients can consult with healthcare providers, receive prescriptions, and have medications delivered—all without leaving their homes. This approach is particularly beneficial for individuals with mobility issues, chronic conditions, or those living in remote areas. By leveraging telehealth, pharmaceutical companies can ensure that patients receive timely and efficient care, further solidifying the advantages of the DTC model.

Potential Drawbacks and Concerns

Fragmentation of Healthcare

While DTC sales may streamline the pharmaceutical supply chain and potentially lower drug costs for consumers, it could contribute to further fragmentation in the healthcare system. Patients obtaining their prescriptions from one source while receiving other aspects of their care elsewhere might lead to a more siloed and transactional healthcare experience. Glass expresses concerns that this fragmentation could increase costs and detract from the value that comes from a more integrated and holistic approach to patient care.

Fragmentation can also pose challenges for healthcare providers, who may struggle to coordinate care across multiple platforms and sources. The lack of cohesive communication between different healthcare stakeholders can lead to gaps in patient care, potentially compromising outcomes. To mitigate these risks, it is essential for pharmaceutical companies and healthcare providers to collaborate and develop integrated solutions that ensure continuity of care. Emphasizing patient-centric approaches and fostering communication between all parties involved can help maintain the quality and effectiveness of healthcare delivery.

Balancing Market Opportunities and Patient Outcomes

As more pharmaceutical companies explore the DTC model, they must balance market opportunities with considerations for patient outcomes. Ensuring that the shift to DTC sales does not exacerbate existing fragmentation in the healthcare system is crucial. The ultimate goal should be to benefit patients by providing more accessible, affordable, and effective medicinal solutions while maintaining a cohesive healthcare experience. Companies need to prioritize patient well-being and align their strategies with broader healthcare goals to achieve long-term success.

Investing in comprehensive patient support programs and ensuring transparency in pricing and services can help achieve this balance. Pharmaceutical companies must also be vigilant in monitoring patient outcomes and continuously improving their products and services based on feedback and data. By striking the right balance between market opportunities and patient outcomes, companies can contribute to a more effective and patient-centered healthcare system that benefits all stakeholders involved.

The Future of Direct-to-Consumer Pharmaceutical Sales

Observing Industry Pioneers

The successes and challenges faced by pioneers like Pfizer and Eli Lilly in the DTC space will likely influence the future strategies of other pharmaceutical giants. As more drugmakers explore the DTC model, they must keep patient outcomes at the forefront of their decisions. Companies will need to invest in building robust consumer relationships and ensuring that their products remain affordable and accessible to the broadest patient base possible. The experiences of early adopters will provide valuable insights and lessons for the industry as a whole.

Closely monitoring market trends and patient feedback will be essential for shaping future DTC initiatives. Pharmaceutical companies must remain agile and responsive to changes in consumer behavior and healthcare needs. By learning from the successes and setbacks of industry pioneers, companies can refine their strategies and develop innovative solutions that meet the evolving demands of the healthcare landscape. The continued growth of DTC sales will depend on the ability of companies to adapt and innovate while prioritizing patient welfare.

Enhancing Patient Empowerment

Lately, the pharmaceutical industry has been experiencing a noteworthy shift towards direct-to-consumer (DTC) sales and services. More and more pharmaceutical companies are choosing to sell their products directly to consumers, effectively bypassing traditional intermediaries like wholesalers, distributors, and pharmacies. This transformation is spurred by multiple potential benefits, such as cost savings, improved collection of consumer data, and the ability to bypass some insurance restrictions. By sidestepping these traditional channels, pharmaceutical companies can better control their pricing structures and improve profit margins. Additionally, direct sales allow companies to gather detailed consumer insights, enabling them to refine their marketing strategies and product offerings more effectively. This shift also has the potential to enhance access to essential medications for a broader audience, offering more convenient purchasing options for consumers. As a result, the entire healthcare landscape could undergo significant changes, potentially leading to a more personalized and efficient system.