Biosimilars are a relatively new arrival in the pharmaceutical industry, yet their potential drives acquisitions and apparently people not knowing about them is a major faux pas.

In a recent PWC survey on top health industry issues, 67 percent of the respondents did not know what a biosimilar is (check point 9 of the slideshow here). Therefore it could prove useful to clarify a few details in what biosimilars are concerned.

What are biosimilars?

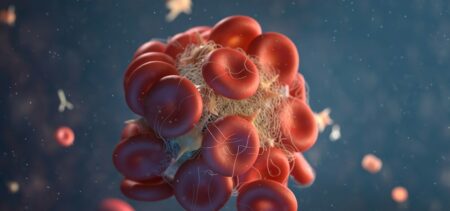

First, think medication and drugs. An original product, once its original patent expires, is available for other drug manufacturing companies to step in and get the approval to produce an almost identical product, based on the patent, without having access to the original product’s molecular clone or cell bank. These secondary versions are the biosimilars – and they must carry reference to the original product.

Biosimilars are not structurally similar to generics because these drugs are not exact copies of the original products, and they are quite sensitive to changes in the manufacturing process. Compared to the small-molecule or generic drugs, biosimilars are 200 to 1000 times bigger and definitely more structurally complex.

Besides this, this type of drugs is manufactured in living cells via a multi-step process, which is the reason for post-translational (following the extraction of the protein structure from the initial DNS sequence) processes having such an impact on their quality, safety or effectiveness.

Only minor clinically meaningful differences are acceptable in biosimilars in order for them to get the necessary approvals, a crucial characteristic that the BPCI (Biologics Price Competition and Innovation) Act underlines.

Essential facts about biosimilars

- They are similar but not identical to the reference drug they copy;

- They can appear only after the original patent for the reference drug expires; in the U.S. there is a 12-year exclusivity period negotiated by the biotech companies that prevent any legal biosimilar from entering the production and commercialization process during the first 12 years of original biologic drug production – the data exclusivity amendment included in the BPCI Act, also known as the PPAC Act, since it passed under this name);

- Bringing a biosimilar to market may also take quite a few years, since the research involved takes about one and a half years, the process development and other improvements also take another subsidiary year and a half; add another 3 years and a half to 4 and a half years to complete the analytical, clinical and non-clinical studies and the entire process may take up to 8 years until the biosimilar in cause is released onto the market;

- They are bigger in size at the molecular level (for example the acetylsalicylic acid is composed out of 21 atoms in its generic version – its formula is C9H8O4; the Human Growth Hormone, a small biologic product, is composed out of 3000 atoms, and the monoclonal antibody, which is a large biologic product is composed out of 25,000 atoms – see the source above);

- The biosimilars are expected to gain traction since many important biological drugs should reach the end of their patent-protected exclusivity by 2020 and the biosimilars industry could benefit from all these opportunities; although it is rather unclear what is the attraction in producing biosimilars due to their high costs both in production, as well as in what the FDA approval process is concerned, the drug manufacturers are extremely attracted towards this new manufacturing concept);

- With the current configuration of things, the cost-saving elements are yet uncertain; producing biosimilars involves a lot of costs, some of them strictly related to the FDA approval process, others having to do with the necessary living cells genetic modification processes and the trials; only if the actual manufacturing process would include innovative solutions (perhaps 3D drug printing?), the biosimilars-producing companies could reduce the final product costs;

- Biosimilars are not interchangeable – each different version has to undergo its own process of research, testing and approval; pharmacists cannot replace one biosimilar with another, but they have to follow the prescription literally;

What is the attraction in biosimilars?

This same question leaps to mind even after going through the entire explanative process above. Why would pharmaceutics companies go through all the efforts involved in producing biosimilars?

Perhaps we should re-iterate that the biosimilars only relate to one class of reference drugs – the biologics. These drugs do not originate in chemical synthesis, but in applying specific processes to living cells. Insulin is a biologic – a large-molecule, protein-based drug. The other categories from this class of drugs are vaccines, allergenic meds, recombinant therapeutic proteins and so on.

To simplify the image, biosimilars are to biologics what generics are to chemically synthesized drugs. Only that, due to their complexity (both in reference drugs as in their copies), biosimilars are not interchangeable and require a different regulatory framework. The companies that will produce biosimilars would compete in coming up with the most efficient copy at the best price. If the means of drug production will indeed become more dynamic and flexible, going for this competition might be the next opportunity for the mid-sized to big players in this field.

The price-decreasing topic received a full feature on NY Times in late 2015, but it still circles around the answer to the “why” question. Perhaps there are yet a few pieces in this puzzle to be revealed.